Three years ago, 28-year-old Blaisey Arnold entered a local auto dealership and came away with the keys to an $84,000 Chevy Tahoe.

But this month, the wedding photographer and mother shared a video to TikTok describing how she was forced to sell her dream car.

Despite paying $1,400 a month in payments totaling more than $50,000, she still owes a balance of $74,000 to her lender - GM Financial.

Not only did she not make a down payment, she said she traded in a previous car on which she had fallen into negative equity.

Negative equity occurs when a driver owes more on their car loan than the vehicle is now worth. Sometimes, a dealer or lender can offer to roll the balance of an existing auto loan onto a new one, making it more expensive.

Blaisey Arnold, 28, spent three years paying $1,400 to service a $84,000 loan she took out to buy a Chevy Tahoe

Pictured is Arnold's $84,000 Chevrolet Tahoe, which was financed by GM Financial

While rolling over debt into a new loan can seem convenient, it can be very dangerous and dealers have been known to not properly inform buyers that they will still be responsible for the remaining balance.

'Honestly, it blows my mind that I have paid $50,000 into this car and only paid off $10,000,' Arnold said.

She told DailyMail.com the loan was issued to her on the very day she visited the dealer - and that had an APR of 10.2 percent.

'I did not go with my husband and as a female I feel they took advantage of me. They knew I really wanted the car and that I was by myself,' she said.

The $84,000 loan was issued to her by GM Financial, the financial services arm of General Motors and the only lender to approve her on the day.

'The dealer pretty much told me they can get me out the door with the car within an hour. He didn't act like it was something I should be concerned about,' she said.

GM Financial told DailyMail.com they were unable to discuss Arnold's loan and passed on an opportunity to comment.

A 2021 study from Consumer Reports found that lenders are increasingly able to prey on the vulnerable, especially those with lower credit scores. Such loans earn them more on interest and they can ultimately repossess cars.

Auto loans are becoming a major source of strain for car-obsessed Americans and leaving an increasing number with runaway debt.

Last year, auto debt in the US reached a record-high $1.6 trillion, which comes out to an average of more than $13,000 per household.

In February, the Federal Reserve released data showing that Americans were falling behind on car payments at the highest rate since 2010.

In recent years the cost of car ownership has soared. Not only are automakers charging more for new cars, used cars are getting more expensive as well.

In the two years after January 2020, used cars and trucks increased more than 50 percent in price, according to figures from the US Bureau of Labor Statistics.

Meanwhile, the cost of insurance is also on the up. In March it was one of the main drivers of inflation measured by the Consumer Price Index (CPI) - having risen 2.6 percent month-over-month.

Arnold said getting stung taught her a lesson - and has since told her followers she is trying to get ride of the Tahoe.

'I'm getting older and realizing more about life and having a family and the things you have to pay for and the cost of living,' she said.

'I'm done with any kind of loans and now have plans to pay everything off.'

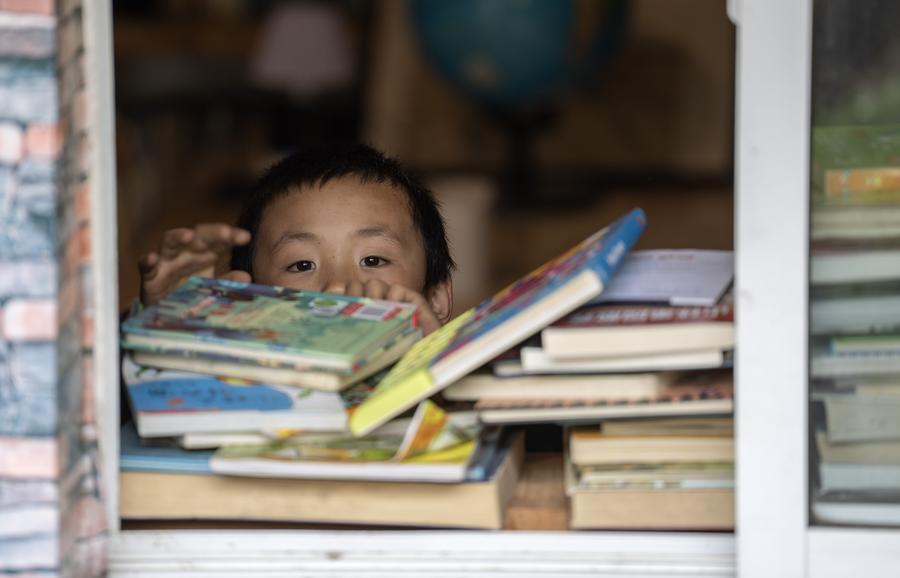

Event to promote love of reading to be held in Kunming

Event to promote love of reading to be held in Kunming Chinese legislators endorse tighter control over Hong Kong, Australia concerned over move

Chinese legislators endorse tighter control over Hong Kong, Australia concerned over move China crackdown on Tiananmen Square commemorations extends to Hong Kong

China crackdown on Tiananmen Square commemorations extends to Hong Kong Ancelotti calls for courage, personality vs. Man City

Ancelotti calls for courage, personality vs. Man CityOverseas hanfu clubs serve as cultural ambassadors

A student from the Confucius Institute of Belgrade poses in hanfu in the Serbian capital in Septembe ...[Detailed]

A student from the Confucius Institute of Belgrade poses in hanfu in the Serbian capital in Septembe ...[Detailed]Coronavirus China: Wuhan lab staff 'had virus symptoms before first confirmed cases'

Your web browser is no longer supported. To improve your experience update it here ...[Detailed]

Your web browser is no longer supported. To improve your experience update it here ...[Detailed]Rampaging elephant herd razes 500km path of destruction

Your web browser is no longer supported. To improve your experience update it here ...[Detailed]

Your web browser is no longer supported. To improve your experience update it here ...[Detailed]School buildings: Central Auckland school left with no gym for years

Auckland Girls' Grammar principal Ngaire Ashmore and the unusable gymnasium. Photo: Supplied ...[Detailed]

Auckland Girls' Grammar principal Ngaire Ashmore and the unusable gymnasium. Photo: Supplied ...[Detailed]Hawks' Trae Young says he feels better after late

ATLANTA (AP) — A healthy Trae Young gives the Atlanta Hawks’ their best hope for overcoming season-l ...[Detailed]

ATLANTA (AP) — A healthy Trae Young gives the Atlanta Hawks’ their best hope for overcoming season-l ...[Detailed]Cruise expert gives his verdict on Icon of the Seas' most expensive restaurant

Sagging bridge ‘warning shot’ work needed

By Tim Scott of ...[Detailed]

By Tim Scott of ...[Detailed]Several arrested after brawl breaks out near Auckland harbour

Photo: 123RF ...[Detailed]

Photo: 123RF ...[Detailed]China launches new remote sensing satellite

A Long March-2D carrier rocket carrying the Yaogan-42 01 satellite blasts off from the Xichang Satel ...[Detailed]

A Long March-2D carrier rocket carrying the Yaogan-42 01 satellite blasts off from the Xichang Satel ...[Detailed]Alec Baldwin pleads not guilty to Rust shooting charge

Actor Alec Baldwin. Photo: AFP / ANGELA WEISS ...[Detailed]

Actor Alec Baldwin. Photo: AFP / ANGELA WEISS ...[Detailed]At least 9 dead, 15 missing after migrant boat sinks near Italy

On Your Side: Survey reveals many college students carry credit